FAQ's

A valuation is usually required for a number of reasons by professional bodies. For example, your Insurer or Broker may request one to confirm an items value for replacement in the event of loss or theft, or HMRC may require one to list the assets of the deceased. For which ever reason, a valuation is so much more than just a description and value.

In terms of Insurance, a valuation includes all the essential details and specifics of your item, including digital images which enables Insurance companies to find an adequate replacement or settlement figure. This is extremely important with vintage and antique items, as well as branded goods.

To learn about the different types of valuations produced, and why you might need them, please visit our ‘Valuations Types’ Page.

A JVA Valuer is either a Member or Fellow of The Jewellery Valuers Association (JVA), which is the only independent professional body in the UK and Ireland that oversees valuations undertaken by its members on Jewellery, Gemstones, Watches and Silverware.

An NAJ’s Institute of Registered Valuers Fellow is valuer with ‘fellow’ status, from the UK’s leading authority of jewellery, watch and silverware appraisers.

Becoming a member of the JVA and the NAJ’s Institute of Registered Valuers is no easy task. They both require pre-requisites such as Diplomas in Diamond Grading, Gemmology and Appraisal Theory, along with at least five years valuing experience in the trade. Potential members then have their work assessed, and if they meet the strict standards of the both organisations they are invited to join. It doesn’t end there; as members have their work peer reviewed on a regular basis to ensure they still reach the high standards set and also undertake Continued Professional Development (CPD) to show they are actively keeping updated with technology, education and the trade. Members also have to adhere to the Principles of Good Practice put in place by both organisations. All this ensures that the valuations produced by a JVA or NAJ’s Institute of Registered Valuers valuer will be to the highest standards, in accordance to the specified purpose and needs of the client.

This is a question you will need to ask your Insurance company.

In general, having your jewellery re-valued every three years is common practice, however I have known clients whose Insurance company required a re-evaluation every year.

To ensure you are correctly covered, ask your Insurer or broker about your policy.

Again, this is a question for your Insurance Company. Some policies require you to specify items over a certain value; others have a cap on the total value of items listed; therefore, make sure you know what your Insurance company requires.

This may lead you to only have the items valued that meet the Insurance companies criteria (e.g. over a certain value). However, it is still worth recording any items you may have that are under this threshold.

Sadly, it is only when a client comes to claim on their household policy that difficulty arises with the lower value items. Insurers often want to see proof of ownership and worth (such as by a receipt of purchase), which in most cases the client no longer has.

For lower value items, we can offer a ‘grouped section’, in which we detail similar low value items together, for one fee. This ensures you have the items recorded on a valuation with a value, however it doesn’t cost you the earth to do so. See our ‘Fees’ page for more details.

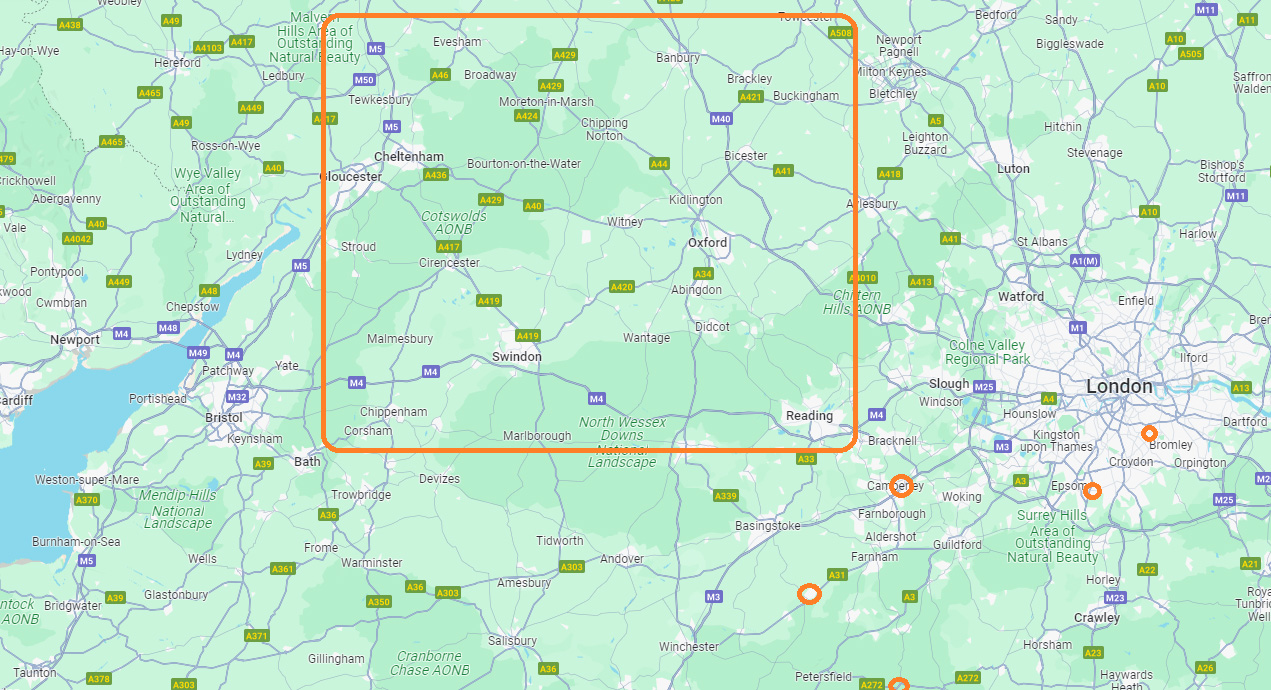

We aim to book in an appointment to assess your items within one week, or another date which is suitable to you. We work seven days a week, and undertake valuations in the evenings to ensure we can work around your schedule.

After the appointment we work on completing the document which takes around three working days; however larger valuations or those undertaken during peak times will take longer. Once complete the document is then posted to you by Royal Mail Signed For 1st Class delivery.

Typically, the answer is no. We pride ourselves on delivering the best service, therefore we take time to research all items fully to ensure they are valued correctly.

There are different methods employed by various valuers involved in charging for their services. These are the most common, and the reason to why we don’t charge this way:

As the valuer is charging a percentage of the total value of the goods assessed, this could lead to the valuer increasing the actual value of goods to increase his charge. This would mean your items are overvalued, resulting in an increase in your Insurance costs, and potentially difficulties further down the line when you are trying to claim. It also means you do not know how much the charge for the valuation will be until it is completed.

• Time based system. In this instance, the valuer would charge a standard fee, and then time how long it takes to complete the valuation, including all research that may be involved. Again, as the valuer is charging for time, it could cause the valuer to take longer, in order to increase the charge. Again, you will not know the charge for the valuation until it has been completed.

• Per Item Charge. This method involves a documenting fee, which covers the production of the valuation document. Each item is then priced individually, based on certain criteria. The benefits of this method are:

-You know exactly how much the valuation will cost before it is undertaken

-There is no bias on the valuer to increase the value of an item, or eek out the time taken to value it. This ensures the valuer arrives at the correct value of each piece. This is the method Crystal Clear Valuations uses, as we feel it provides you with the best value for money, and the most professional efficient service

An Independent Valuer is exactly that – a professional that’s sole business is to value your jewellery, watches and associated items. An independent valuer does not have any affiliation to a Jeweller, Broker or Insurance company, therefore no vested interest in the value placed on your items. They do not purchase Jewellery and Watches, nor trade in them. It also means they have no other focus than assessing your items. At Crystal Clear Valuations, you will only find Independent Valuers, which is a member of the Association of Independent Jewellery Valuers (AIJV).